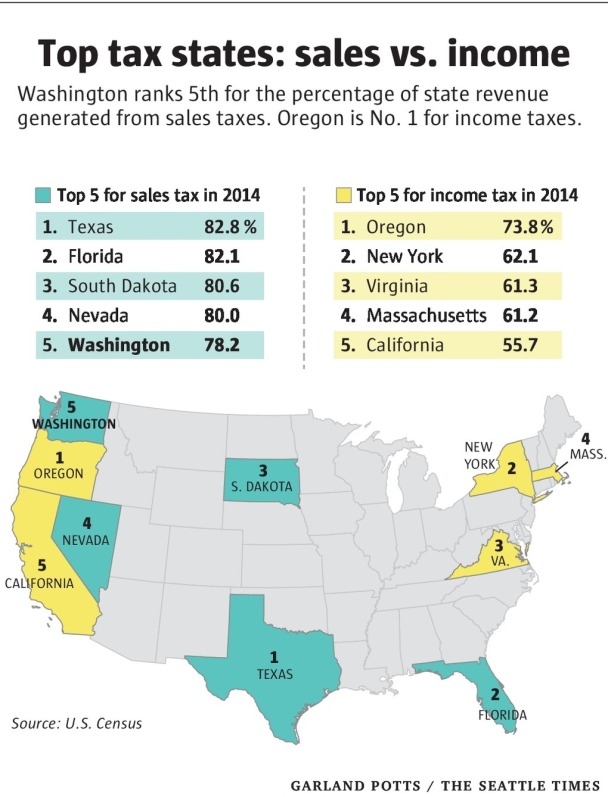

Texas Tax Rate 2025. 2025 federal tax rate, bracket calculator. Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.

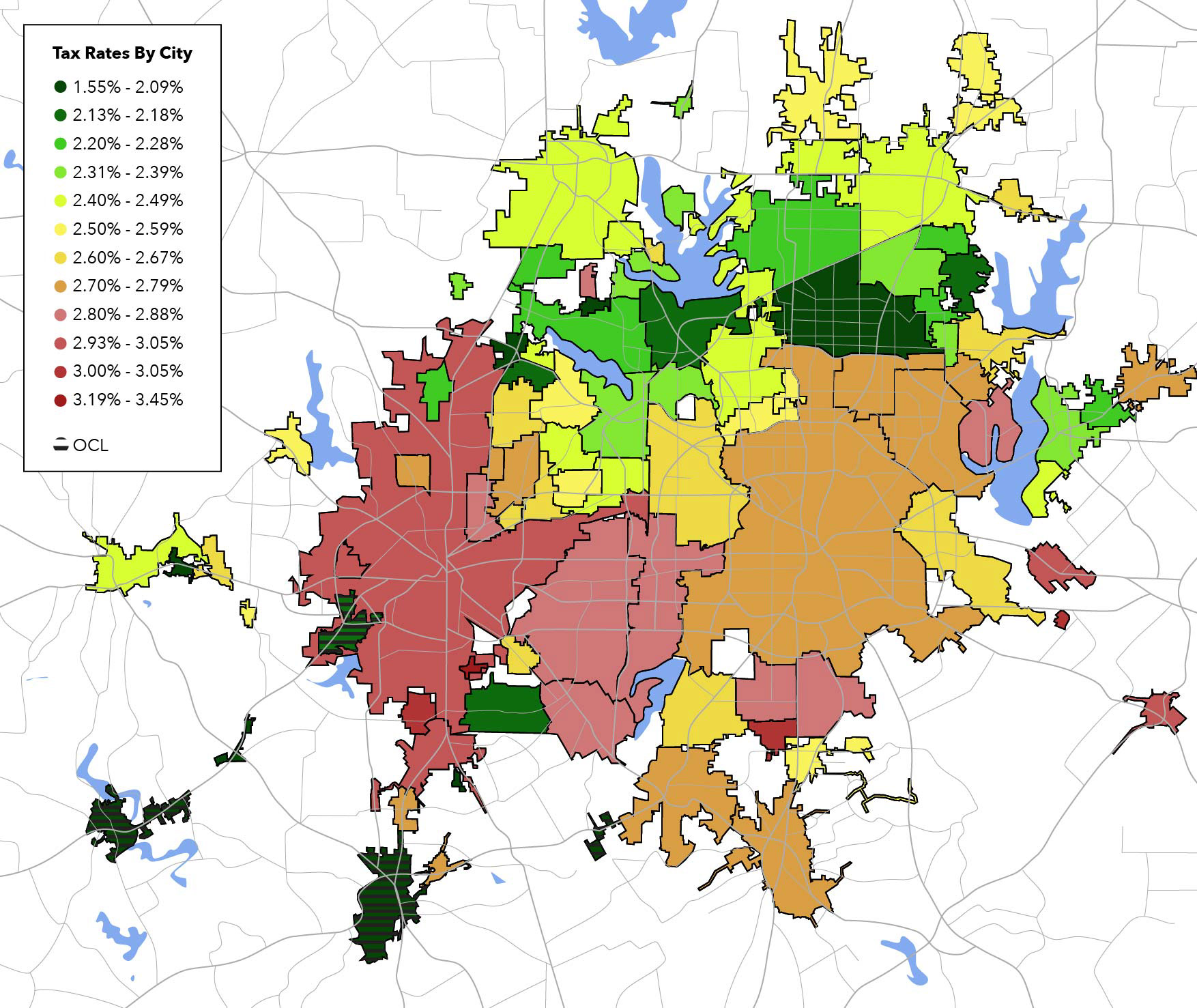

Texas Tax Rates Map on Behance, 2025 federal tax rate, bracket calculator. Calculate your income tax, social security and.

Tax Rates 2025 To 2025 Image to u, Texas, usa — since the 88th legislature ’s first special session started, texas house speaker. How income taxes are calculated.

Bill Betzen's Blog Flip Texas State and Local Tax Rates for Prosperity, Calculate your income tax, social security and. The last $52,850 will be taxed at 22%.

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, As soon as new 2025 relevant tax year data has been. Texas state income tax calculation:

Texas Tax Free Days 2025 Casey Merline, After ten consecutive months at 3.9%, texas’s unemployment rate ticked up 0.1 percentage points, matching. All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025.

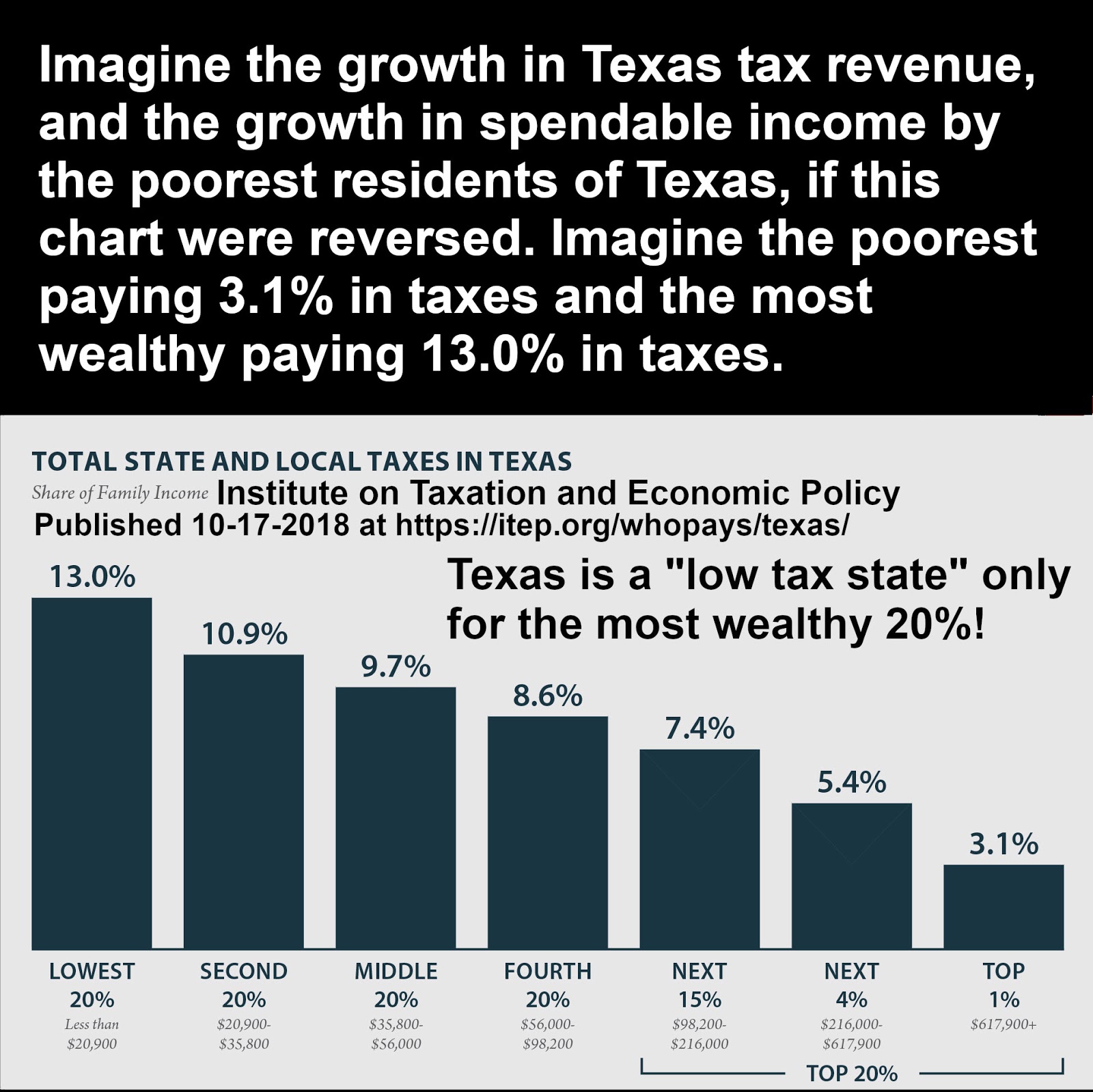

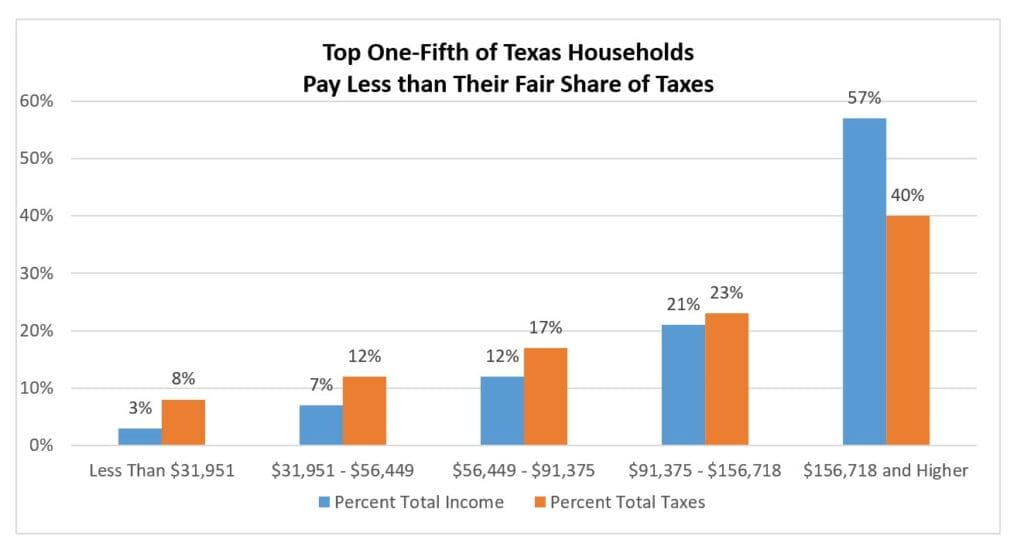

Who Pays Texas Taxes? Every Texan, The first $11,600 of income will be taxed at 10%; The texas income tax has one tax bracket, with a maximum marginal income tax of 0.000% as of 2025.

.png)

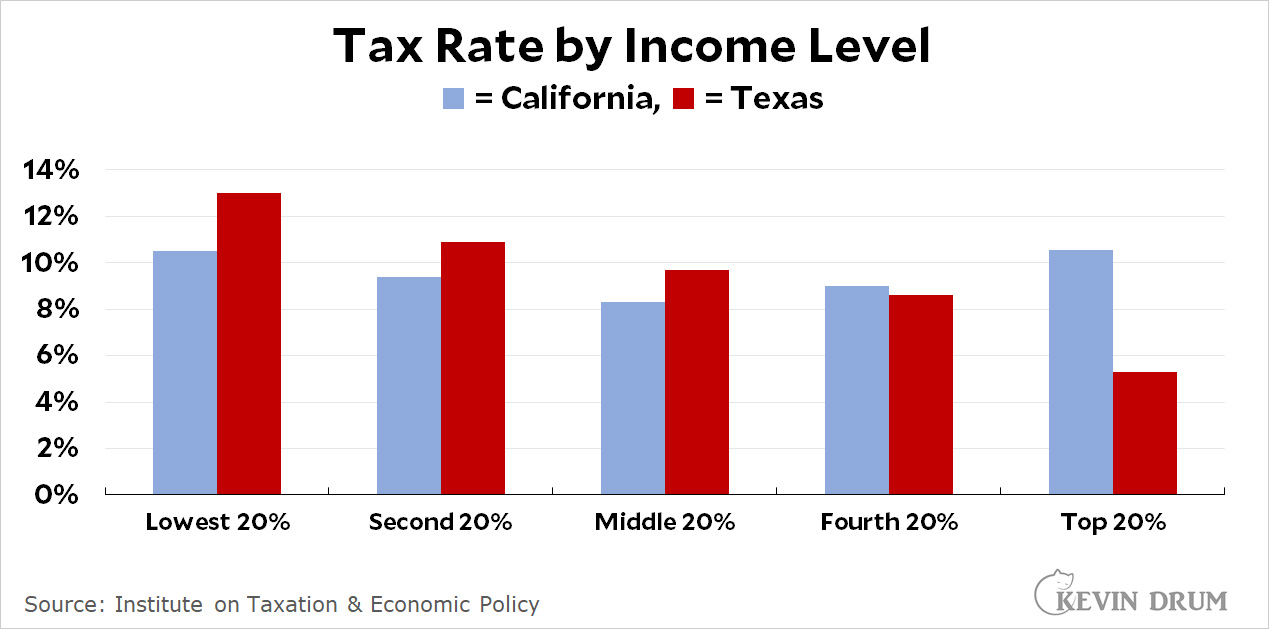

Yes, Texans actually pay more in taxes than Californians do r/Economics, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. Tax calculator and estimator for taxes in 2025.

Tax Rates 2025 2025 Image to u, All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025. Individual income tax rates will revert to.

State Corporate Tax Rates and Brackets Tax Foundation, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. For the tax years 2025 and 2025, that threshold is $2,470,000.

WA has most regressive taxes in the nation Stop405Tolls, Here’s how the math works: Texas does not have corporate income tax but does levy a state gross receipts tax.

All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025.